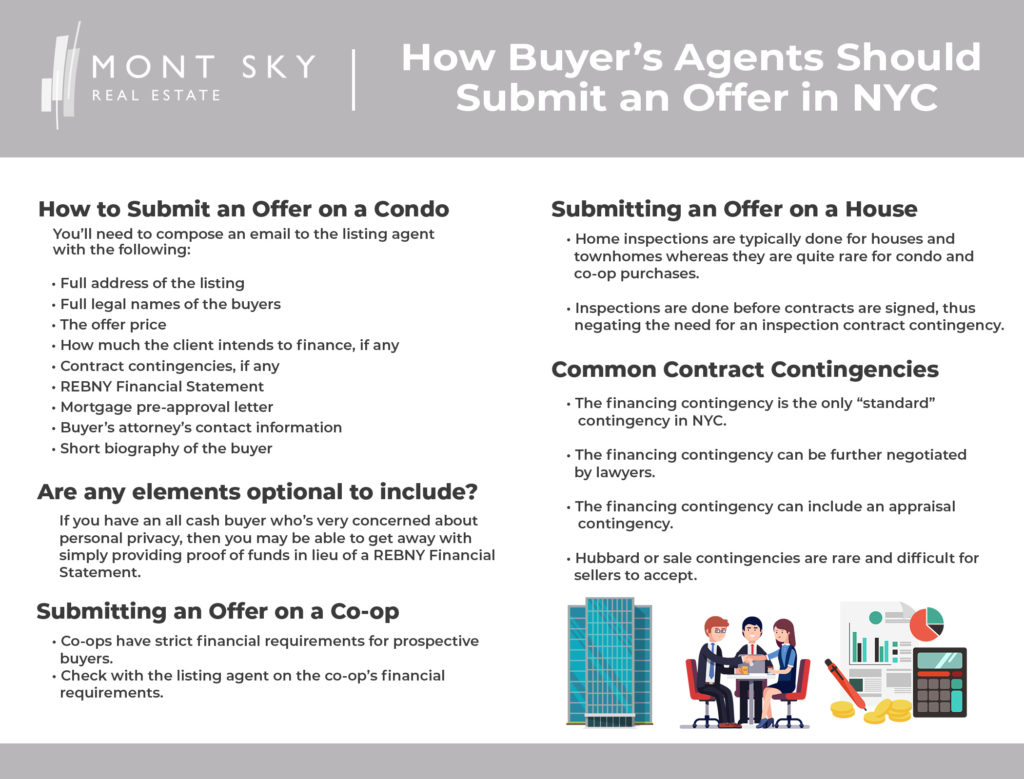

Co-ops have strict financial requirements for prospective buyers

Submitting an offer on a co-op apartment listing in New York City is slightly more complex because co-op buildings will often have stricter financial requirements than that of bank lenders.

For example, many co-op boards will require prospective buyers to have a debt-to-income (DTI) ratio of 25% to 30% at a maximum, while many banks will allow significantly higher DTI ratios in the 40% to 50% range.

Furthermore, many co-ops will require months to even a couple of years of post-closing liquidity vs the much less stringent requirements imposed by lenders. For example, we’ve heard of some major banks requiring 6 months of post-closing liquidity but with many outs on what counts as an expense.

Last but not least, many co-ops will require a minimum percent of down payment for purchases, with 25% or 30% being fairly common. However, some co-ops will go even further and require 50% down or more. You’ll even see the occasional co-op that will require 100% down, meaning no financing allowed!

Check with the listing agent on the co-op’s financial requirements

You should ideally check with the listing agent on whether the co-op has any specific financial requirements around DTI ratios and post-closing liquidity before submitting an offer. For example, if the co-op requires 2 years of post-closing liquidity and you know that your buyer will be completely out of cash after the down payment and closing costs, then it’s probably wiser to have a conversation with your client before wasting everyone’s time on an offer.

Sample email for an financed offer on a co-op

Dear [Listing Agent Name], we are pleased to submit the following offer of $[Price] for [Address] on behalf of our client [Client Name]. Please note that this offer is contingent on financing; however, our client can put up to 40% down. Our client’s debt-to-income ratio is 20% and our client should have approximately 2 years in post-closing liquidity.

We have an attorney on standby ready to review a contract ASAP, and we’ve also included a REBNY Financial Statement (attached), a loan pre-approval letter from Bank of New York (attached) and a short biography for your review. If necessary, we can provide proof of funds in the form of brokerage and bank statements.

Please confirm receipt and let us know if we can do a deal. Thank you!

Attorney Contact Information

Ryan Smith

Smith & Smith Attorneys PLLC

20 West 10th Street

New York, NY 10005

Phone: 212-222-2222

Email: ryan@smithandsmith.com

Short Biography

John Smith is an accountant at Big Consulting LLC based in Battery Park City in Lower Manhattan. John has been an accountant for 10 years and has previously worked at Small Consulting LLC in Chicago for 4 years. John lives with his girlfriend Nancy and enjoys sports, small dinners and rock climbing.